First Nations Trust Fund as of March 31, 2009 information from AANDC web site

From ElyseBruce.wordpress.com blog

About That FN Trust

January 21, 2013 - Elyse Bruce

Before writing about how some of those continuing payment annual sums are spent for the benefit of First Nations peoples, I have to write about the First Nations Trust Fund. The reason I have to address the First Nations Trust Fund first has to do with some of the comments I received on Twitter after sharing yesterday's blog article with the Twitterverse. The comments to which I'm referring are those that allege that any money paid out to First Nations peoples is charity money.

Over the past few days, a document by Robofraud has been circulating online that states that the First Nations Trust Fund is over $2 TRILLION and earns an annual interest of over $35 BILLION.

A trust is a way to hold property that lets Trustees manage the money so it benefits a defined beneficiary. The property that makes up the Trust is usually defined by a written trust agreement. The written trust agreements in this case are the treaties.

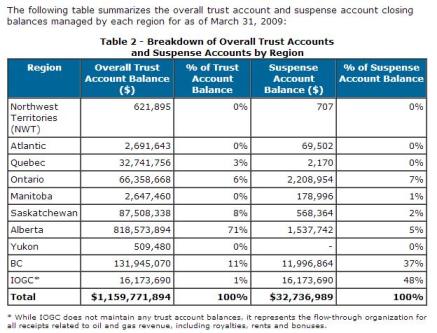

The Aboriginal Affairs and Northern Development Canada (AANDC) provided this information with regards to the monies being held in the First Nations Trust Fund as of March 31, 2009.

Is it possible that the over $2 TRILLION claimed in the Robofraud statement is correct? Since the only figures I was able to find date back to 2009 when it was at $1.15 BILLION, it's not likely that the amount in 2013 is $2 TRILLION. Could it be $2 BILLION? Could be.

Still, $2 BILLION is a sizable amount of money as is the interest $2 BILLION generates on a quarterly basis.

That being said, the First Nations Trust Fund isn't the only money that belongs to First Nations peoples that is handled by the AANDC. According to the website, the Department "may issue licences, permits, and other instruments to individuals and organizations that propose to undertake resource exploration and other types of development projects." That money also belongs to First Nations peoples, doesn't it? If the resource exploration and development projects weren't on First Nations property, there wouldn't be any need for AANCD to involve itself ergo the revenues generated from "licenses, permits and other instruments to individuals and organizations" is First Nations revenues, is it not?

And how about the monies held in accounts that the AANDC identifies as Indian moneys suspense accounts? An Indian moneys suspense account is meant to hold monies "received for individual Indians and bands pending execution of the related lease, permit or licence, settlement of litigation, registration of the Indian or identification of the recipient." The AANDC website goes on to state that "[t]hese moneys are then disbursed to an Indian, credited to an Indian Band Fund or Individual Trust Fund account, or returned to the payer, as appropriate."

What about the Environmental Studies Research Fund Account? It's part of the AANDC as well and records levies pursuant to the Canada Petroleum Resources Act. If it wasn't part of the First Nations portfolio, AANDC wouldn't be dealing with it.

And how about those Special Accounts as identified under Section 63 of the Indian Act - the accounts where funds such as deposits and payments on leases are held for individuals, held to be split between individuals and bands? AANDC controls that money as well.

Indian Estate Accounts need to be included in the total amount of money AANDC controls since Indian Estate Accounts (pursuant to Sections 42 to 51 and 52.3 of the Indian Act) have funds from the estates of deceased First Nations peoples, those deemed mentally incompetent, and 'missing' First Nations peoples. Factoring in the Indian Savings Accounts that are in keeping with Sections 52 and 52.1 to 52.5 of the Indian Act and pretty soon, that $2 BILLION figure from the First Nations Trust Fund is considerably more.

And contrary to popular misconception, Indian Moneys Suspense Accounts aren't what one might think they are. In the Public Accounts Of Canada document for 2011-2012, the Indian Moneys Suspense Accounts are described as accounts to "hold moneys received for individual Indians and bands, that cannot be disbursed to an Indian, or credited to an Indian Band Fund or Individual Trust Fund account, pending execution of the related lease, permit or licence, settlement of litigation, registration of the Indian or identification of the recipient."

In other words, there's all kinds of money that belongs to First Nations peoples that isn't part of the First Nations Trust Fund, and AANDC controls all of it.

"But wait, there's more!" as they say on those television infomercials!

Have the monies due the First Nations peoples from natural resources been taken into consideration as part of FN revenues? What natural resources, you ask?

The next thing to look at, then, are the fiduciary duties of the government towards First Nations peoples. According to the AANDC website, the Trust Fund Management System (TFMS) "is an application used to manage Indian Moneys in Trust. The responsibilities and authorities as outlined by the Indian Act allow the Minister to manage the Indian Moneys as a fiduciary (Statutory obligation of the Minister's fiduciary responsibilities to collect, receive and hold moneys for the use and benefit of Indians or bands and to manage and expend Indian Moneys in accordance with the Indian Act.) "

The next time someone says that First Nations peoples are getting a free ride from taxpayers or that First Nations peoples are mismanaging the money the government gives them, step back and share facts with individuals, corporations and government departments who are riding the slammin' bandwagon.

Education is one of the strongest weapons against ignorance.

Elyse Bruce

For more information

Manual for the Administration of Band Moneys